wake county nc sales tax breakdown

Historical Total General State Local and Transit Sales and Use Tax Rates. Individual income tax refund inquiries.

New Businesses Coming To Wake Forest Town Of Wake Forest Nc

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275.

. Sales Tax Breakdown. Within Wake Forest there are around 2 zip codes with the most populous zip code being 27587. To review the rules in North Carolina visit our state-by-state guide.

This is the total of state county and city sales tax rates. North Carolina Department of Revenue. Did South Dakota v.

Has impacted many state nexus laws and sales tax collection requirements. Wake Forest is located within Wake County North Carolina. Historical County Sales and Use Tax Rates.

The North Carolina state sales tax rate is currently. The North Carolina sales tax rate is currently. If you need access to a database of all North Carolina local sales tax rates visit the sales tax data page.

025 lower than the maximum sales tax in NC. For tax rates in other cities see North Carolina sales taxes by city and county. Individual income tax refund inquiries.

Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. 3 rows Wake County NC Sales Tax Rate. The one with the highest sales tax rate is 27502 and the one with the lowest sales tax rate is 27523.

North Carolina Sales Tax. The sales tax rate does not vary based on. The 2018 United States Supreme Court decision in South Dakota v.

This is the total of state and county sales tax rates. North Carolina Department of Revenue. The Wake Forest sales tax rate is.

Sales Tax Breakdown. The County sales tax rate is. The average cumulative sales tax rate in Wake Forest North Carolina is 725.

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. This includes the rates on the state county city and special levels. What is the sales tax rate in Wake Forest North Carolina.

Sales and Use Tax Rates Other Information. The minimum combined 2022 sales tax rate for Raleigh North Carolina is. PO Box 25000 Raleigh NC 27640-0640.

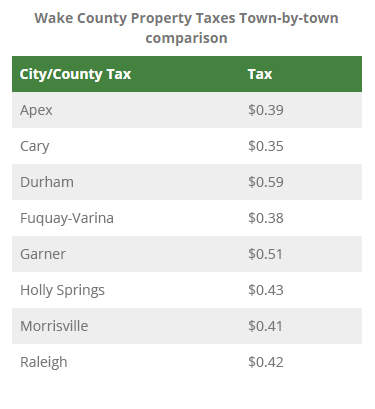

PO Box 25000 Raleigh NC 27640-0640. Click any locality for a full breakdown of local property taxes. The most populous zip code in Wake County North Carolina is 27610.

Sales Tax Breakdown. The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. Average Sales Tax With Local.

Historical Total General State Local and Transit Sales and Use Tax Rates. Sales and Use Tax Forms and Certificates. Sales Tax Breakdown.

The County sales tax rate is. There are a total of 460 local tax jurisdictions. Wake County sales tax.

The current total local sales tax rate in Wake County. North Carolina Department of Revenue. Historical County Sales and Use Tax Rates.

The North Carolina sales tax rate is currently. 22 rows The total sales tax rate in any given location can be broken down into state county city. The Raleigh sales tax rate is.

Alamance 675 Franklin 675 Pamlico 675 Alexander 7 Gaston 675 Pasquotank 675 Alleghany 675 Gates 675. There is no applicable city tax. North Carolina state sales tax.

Historical Total General State Local and Transit Sales and Use Tax Rates. Historical Total General State Local and Transit Sales and Use Tax Rates. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050.

The Wake County sales tax rate is. Sales Tax Breakdown For Wake County North Carolina. This is the total of state county and city sales tax rates.

PO Box 25000 Raleigh NC 27640-0640. The minimum combined 2022 sales tax rate for Wake Forest North Carolina is. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina.

Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. You can print a 725 sales tax table here.

Taxes Cary Economic Development

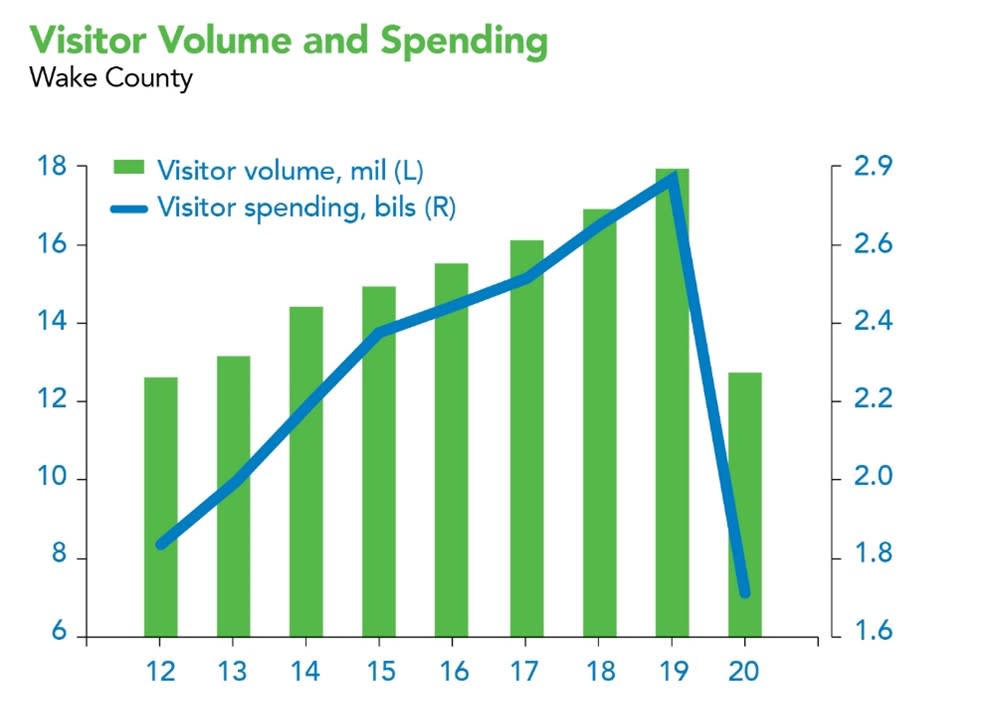

2020 Wake County Visitation Figures Released

Organizational Chart Town Of Wake Forest Nc

Taxes Wake County Economic Development

Wake County North Carolina Property Tax Rates 2020 Tax Year

Wake County Restocking Free N95 Masks On Tuesday Wral Com

Wake Forest Map Town Of Wake Forest Nc

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

/https://s3.amazonaws.com/lmbucket0/media/business/capital-blvd-stadium-dr-4806-1-5cHYchll5gqCzmnjHrQSEM1AsLGMTuGPT9jOTR1wk2k.b02d4054bef2.jpg)

T Mobile Capital Blvd Wake Forest Nc

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

North Carolina Sales Tax Rates By City County 2022

How To Find Out If Your Wake County Property Tax Is Going Up Abc11 Raleigh Durham

Wake County North Carolina Nc Jobs Wake Employment Opportunities Directory

2020 Wake County Visitation Figures Released

Historic Districts Town Of Wake Forest Nc

North Carolina Sales Tax Small Business Guide Truic

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

School Reviews For Wake County School District School District Wake County School Reviews